Commercial energy costs continue rising, with peak demand charges accounting for up to 50% of monthly bills. Smart businesses are turning to demand-side response programs to cut these expenses significantly.

We at Spinifex Energy have seen companies reduce their energy costs by 15-30% through strategic demand management. The key lies in understanding when and how to adjust your energy consumption patterns.

What Demand-Side Response Programs Are and How They Work

Demand-side response programs pay commercial users to reduce electricity consumption during peak periods or when the grid faces supply constraints. These programs operate through automated systems that monitor grid conditions and send signals to participating businesses when demand reduction is needed. The Australian Energy Market Operator coordinates these programs, with participants receiving payments from $300 to $69,000 per megawatt per year (depending on program type and market conditions).

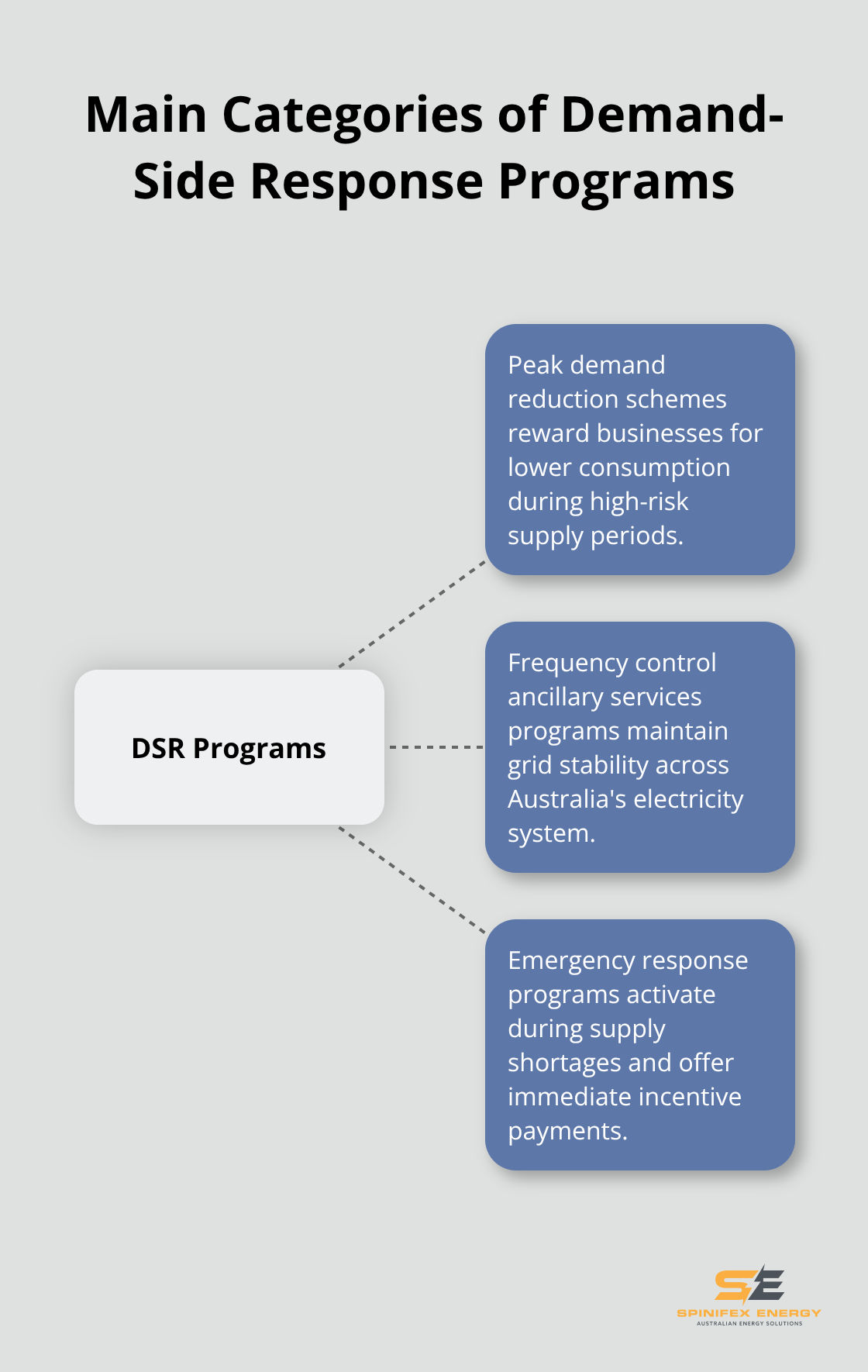

Three Main Program Categories

Commercial users can access three distinct program types. Peak demand reduction schemes like those in New South Wales reward businesses for lower consumption during high-risk supply periods. Frequency control ancillary services programs maintain grid stability, with providers maintaining grid frequency reserves across Australia’s electricity system. Emergency response programs activate during supply shortages and offer immediate incentive payments to participants who reduce demand within short notice periods from grid operators.

Financial Returns That Matter

The numbers demonstrate clear DSR program profitability. Cold storage facilities offset up to 10% of rising electricity costs through demand response participation. Load flexibility generates significant value across Australia when considering higher distributed energy resource scenarios through ARENA research. A 1000 MW flexible demand capacity produces approximately $300 million in annual bill savings for the electricity market according to RACE for 2030 CRC studies.

Streamlined Program Management

Programs handle enrolment, measurement verification and payment processing automatically. This approach makes participation straightforward for busy commercial operators focused on core business activities. The next step involves understanding which specific DSR strategies deliver the highest returns for your facility type and operational requirements.

How Do You Execute High-Impact DSR Strategies

Peak load shifts transform energy costs through precise timing adjustments that capitalise on wholesale price fluctuations. Commercial facilities achieve the highest returns when they move energy consumption from peak hours to off-peak periods through demand side management, which lowers overall peak load demand and improves grid stability. Manufacturing operations report significant monthly savings through strategic load shifts, particularly when combined with time-of-use pricing structures. Cold storage facilities demonstrate exceptional results by pre-cooling during low-price periods and reducing compressor loads during peak hours, achieving substantial cost reductions according to recent industry data.

Energy Storage Amplifies DSR Returns

Battery storage systems multiply DSR effectiveness by storing energy during low-cost periods and discharging during peak demand events. Commercial installations with battery capacity generate substantial annual returns through arbitrage opportunities alone. Tesla Megapack installations at commercial sites demonstrate attractive payback periods when optimised for both demand charge reduction and grid services participation. The key lies in sizing storage systems to handle peak demand while maintaining sufficient capacity for emergency backup operations.

Automated Response Systems Drive Consistent Performance

Smart control systems outperform manual DSR participation through real-time price monitoring and instant load adjustments. Advanced energy management platforms integrate with HVAC systems, lighting controls, and production equipment to execute demand reductions within notification windows required by frequency control markets. Companies that use automated systems achieve higher event participation rates compared to manual responses, translating to significantly higher annual payments per megawatt of flexible capacity according to market data.

Technology Integration Maximises Flexibility

Modern DSR platforms connect multiple building systems to create comprehensive demand response capabilities. Smart meters provide real-time consumption data while automated controls adjust lighting, HVAC, and equipment loads based on grid signals. These integrated systems respond to price signals within seconds, capturing maximum value from volatile wholesale electricity markets that can spike during peak periods.

Success with these strategies requires accurate measurement and continuous optimisation to track your actual savings and performance metrics.

How Do You Track DSR Performance

Accurate measurement starts with baseline energy consumption data from the 12 months before DSR participation begins. Smart meters capture consumption patterns at 5-minute intervals and provide granular data needed to calculate actual demand reductions during events. Commercial facilities must document peak demand levels, time-of-use consumption patterns, and monthly demand charges to establish performance benchmarks. The Australian Energy Market Operator requires verification of load reductions within 48 hours of each event, which makes precise measurement systems mandatory for payment eligibility.

Real-Time Monitoring Drives Higher Returns

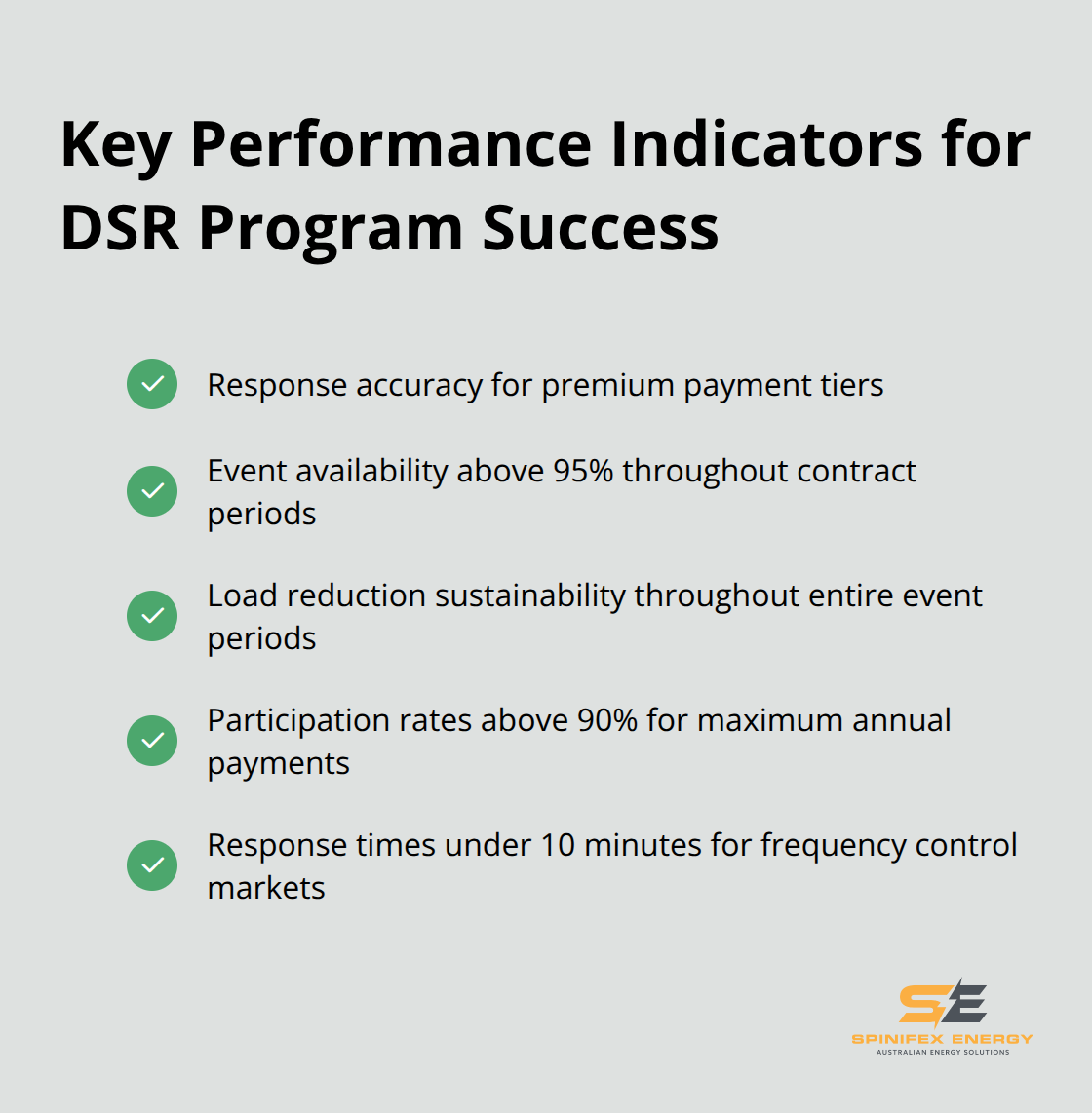

Advanced energy management platforms track multiple performance indicators simultaneously. Event participation rates above 90% generate maximum annual payments, while response times under 10 minutes capture premium pricing in frequency control markets. Monthly demand charge reductions of 15-25% indicate effective peak shaving strategies and translate directly to cost savings. Facilities that achieve consistent 5-10% load reductions during called events typically earn $500-$2,000 per megawatt annually through DSR programs. Temperature-adjusted baselines account for seasonal variations and prevent measurement errors that reduce payments.

Data Analysis Optimisation

Monthly performance reviews identify patterns that maximise DSR earnings. Facilities with automated systems achieve 40% higher participation rates compared to manual responses (according to market data). Load forecasting accuracy enables proactive demand management and captures additional savings through wholesale market participation. Equipment cycling schedules optimised for DSR events reduce operational wear while they maintain production targets. Companies that analyse hourly price data achieve 20-30% higher returns through strategic load shifts during volatile market conditions.

Performance Metrics That Matter Most

Key performance indicators determine DSR program success rates. Response accuracy qualifies facilities for premium payment tiers through proper market design integration. Baseline deviation penalties can reduce monthly payments by 10-15% when measurement systems fail to account for weather variations.

Successful participants maintain event availability above 95% throughout contract periods (typically 12-24 months). Load reduction sustainability throughout entire event periods prevents payment clawbacks that occur when facilities cannot maintain reduced consumption levels.

Final Thoughts

Demand-side response programs offer commercial facilities a proven path to reduce energy costs by 15-30% while they support grid stability. Success requires automated systems that achieve 90% participation rates, accurate baseline measurement, and continuous performance optimisation. The financial returns are substantial, with facilities earning $300-$69,000 per megawatt annually (depending on program participation).

The operational benefits extend beyond immediate cost savings. Companies gain advanced energy management capabilities, improved demand forecasting, and reduced exposure to volatile wholesale electricity prices. These advantages compound over time and create sustainable competitive advantages through lower operating costs.

Implementation success depends on selecting the right technology partners and program combinations for your facility type. We at Spinifex Energy help clients optimise electricity expenses and integrate demand-side response strategies with solar power and battery storage solutions through tailored energy consulting services. The next step involves conducting a facility energy audit to identify your highest-value DSR opportunities and establish baseline measurements for program participation.