What are the common structures for financing a solar system? In the ever-growing confusion surrounding solar system payment options it may be surprising that an outright purchase of a solar system may not reflect the highest yielding returns for tax-paying businesses. We try to unpack the various methods of funding a purchase and analyse the advantages and disadvantages of both.

Outright Cash Purchase

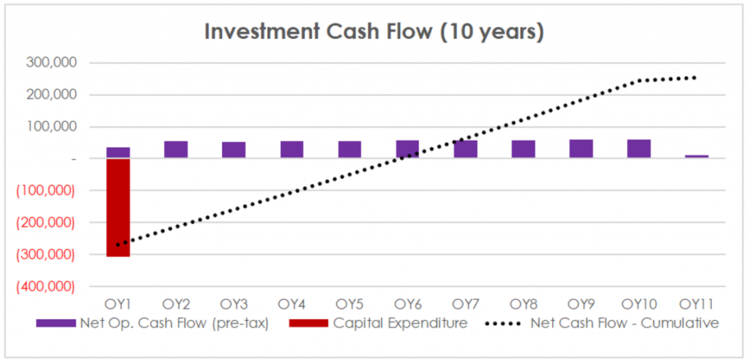

Whether a business has readily available cash to fund the purchase is usually a deciding factor, but paying cash is often considered the best option for purchasing a solar system. However, given the standard life of a solar system is 25 years this presents a lengthy term to depreciate your assets.

Advantages:

- Complete ownership with no further interest or payments;

- Simple transaction between supplier and customer;

- Businesses can claim GST on the purchase and a tax depreciation of 5% for 20 years (ATO guidelines).

Disadvantages:

- If cash flow is king for a business the cons of a large upfront capital expenditure may outweigh the pros;

- Improved profitability may lead to a higher tax liability;

- The cash flow positive tipping point (payback period) may be 3-6 years.

Business Loan or Chattel Mortgage

Business loans are widely recognised as a method of securing finance for a solar system. When the solar system is secured against itself it is known as a chattel mortgage. Loans and chattel mortgages are primarily sourced by not-for-profit and community organisations who cannot benefit from tax breaks.

Advantages:

- No upfront capex requirements;

- GST on the purchase is claimable;

- A competitive loan market means wide variety of providers and rate options; and

- Rapid pay down when cash flow permits reduces overall interest payments.

Disadvantages:

- The loan market is dynamic so payments may not be fixed;

- Interest payable on loan;

- Balance sheet records the solar asset and borrowing; and

- Loan repayments are not deductible.

Operating Lease

An operating lease allows a business to benefit from an asset through a contract without exchanging ownership. Additionally, the liabilities associated with a leased asset (ongoing rental payments) usually don’t sit on the balance sheet. The term of a lease can be flexible and can usually include buyout options or lease renegotiation at the conclusion of the term. This financing method is the most widely adopted in solar systems.

Advantages:

- No upfront capex required;

- Lease payments are usually fixed and 100% tax deductible;

- GST on payments are claimable;

- Savings improve if the system is purchased at the conclusion of the initial term;

- Suitable for owner/occupiers and rental properties alike (rental agreement usually transferable); and

- Cash flow positive from day one as rental costs are usually lower than energy savings.

Disadvantages:

- The full extent of the savings are not enjoyed until ownership is transferred.

- The end of lease ownership transfer needs to be confirmed with finance company and discussed in full.

Power Purchase Agreements (PPA)

A PPA generally involves a business benefiting from lower energy rates produced from solar without purchasing the system. The owner of the system (usually the solar installation company) retains ownership, maintains and monitors it while supplying the tenant with renewable energy at a reduced rate to the grid.

Whilst a PPA is not technically a finance option it is often considered in the same group. Key reasons being there is no upfront capital expenditure from the party benefiting from the system and often an ownership transfer option at the end of the term.

PPA’s are attractive to organisations who don’t have access to cash for a purchase and don’t want to pay interest.

Advantages:

- No upfront capital expenditure;

- Cash flow positive from day one;

- Energy costs tax deductible;

- Management, maintenance and monitoring of the system is the responsibility of the system owner; and

- System purchase options available at the conclusion of the term of the PPA (traditionally 10, 15 and 20 years).

Disadvantages:

- Depending on the configuration there may be separate bills from energy retailer and PPA provider;

- Typically, longer contract terms to finance (10-20 years);

If you want to discuss any of the above article or solar options available to you please don’t hesitate to make contact.

0 Comments