Enter your details for instant pricing and next steps.

Ready to get started? Enter your details for further information or to talk to one of our PPA experts.

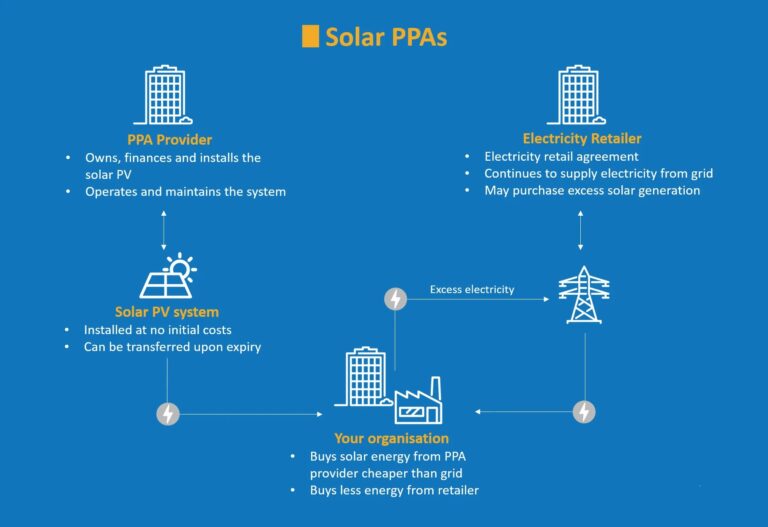

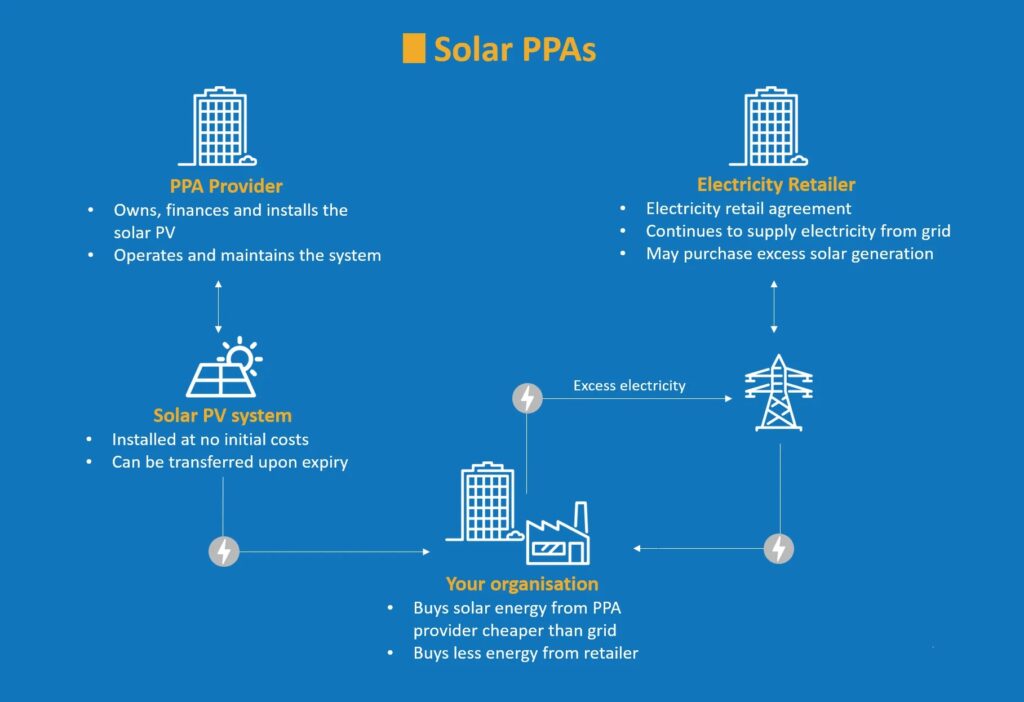

Power Purchase Agreements (PPAs) offer businesses a cost-effective pathway to adopt solar energy without the burden of initial capital expenditure. By entering into a PPA, you can enjoy the benefits of solar power while we handle the installation, operation, and maintenance of the system.

What is a PPA?

A PPA is a long-term agreement where we install a solar energy system on your premises at no upfront cost. You purchase the electricity generated at a predetermined rate, often lower than traditional grid prices.

This arrangement allows you to access clean energy and reduce your electricity bills without owning or maintaining the system.

Discover how much a solar PPA can save you. Our team can often provide an estimate within 5 minutes to illustrate the power of a PPA.

Would you like to retain available capital to fund other projects?

Would you like to outsource the cost and effort of maintaining the asset?

Do your strengths lie in running your core business while a third party operates your solar system?

Are you risk averse preferring to avoid working on system downtime and failures?

You start using the generated solar energy from day one, which is cheaper than energy from the grid.

There is no capital outlay with a PPA, so there is no cash required and the asset does not appear on your balance sheet.

The system is owned, operated, maintained.

BlackMilk recently renewed their electricity supply contracts with energy charges approximately 80% higher than their previous term.

They were able to secure a solar PPA that locked in over 40% of their annual energy consumption at a cheaper rate than grid energy.

The PPA derisked a large percentage of their bills mitigating the rising grid energy costs without paying any upfront capital for the solar system.

There are three main types of Power Purchase Agreements (PPAs): On-site PPAs, Off-site PPAs, and Virtual (or Synthetic) PPAs. Each structure suits different energy goals and site constraints.

On-site PPAs involve renewable energy systems (usually solar) installed directly at the customer’s premises. The customer consumes the energy generated on-site and pays a fixed rate per kWh, usually lower than grid prices, without owning or maintaining the system.

Off-site PPAs involve a direct contract with a renewable energy project located elsewhere. Power is delivered via the grid, allowing access to large-scale renewable generation without needing space for infrastructure.

Virtual PPAs are financial agreements where no physical power is delivered. Instead, the customer agrees to a fixed price for electricity from a project, settling the difference between market and contract price. These are common with large corporates seeking renewable energy certificates and hedging benefits.

PPAs are most commonly used by large energy consumers, including commercial businesses, manufacturers, data centres, governments, and institutions like universities and hospitals. These organisations often have high, predictable electricity demand and are motivated by cost savings, carbon reduction targets, or energy security.

In Australia, businesses with electricity spend above ~$250,000 per year are often good candidates for a PPA, though smaller organisations are increasingly exploring options through group or aggregated deals.

Some PPAs are structured for landlords or property managers, allowing them to install solar across multiple tenancies and recover costs through tenant billing. Public sector organisations also adopt PPAs to meet renewable energy mandates and long-term budget planning needs.

Because PPAs can be structured with no upfront capital and are usually off-balance-sheet, they appeal to CFOs and sustainability officers alike. Ultimately, any energy user with long-term site security and a focus on cost or emissions reductions can benefit from a PPA.

No, you don’t need to own your building to enter into a Power Purchase Agreement (PPA)—but you do need long-term control of the site and the landlord’s consent. PPAs are typically long-term contracts (10–25 years), so the developer needs assurance that the system can stay in place for the full term. If you’re leasing your premises, most providers will require a lease that either matches or exceeds the PPA term, or includes renewal options.

In many cases, landlords are open to PPAs, especially when the solar system enhances the property’s value or offers benefits to tenants. Some agreements even allow the landlord to participate in the savings or take over the PPA if a tenant vacates.

It’s a good idea to involve your landlord early in the process. With the right approvals in place, tenants can enjoy the cost savings and sustainability benefits of a PPA—no property ownership required.

No—while solar is the most common technology used in PPAs, especially for on-site installations, PPAs can also apply to wind, battery storage, and even hybrid systems. Off-site and virtual PPAs often involve large-scale wind or solar farms, depending on regional resources and grid connections.

Battery storage is increasingly being included in PPAs to help manage peak demand charges and increase energy self-consumption. Some PPAs also support firmed renewables, where the supplier provides a stable supply by integrating multiple generation sources or using the wholesale market to deliver a consistent product.

In Australia, solar PPAs are most common due to high solar irradiance and falling installation costs. But as technology evolves and energy needs become more complex, PPA structures are expanding to cover a broader range of clean energy solutions tailored to each customer’s load profile and goals.

At the end of a PPA term, you typically have several options, depending on the agreement. The most common are:

System Buyout – You purchase the system at fair market value or a pre-agreed price (usually $0, depending on the lenght of PPA), gaining full ownership and keeping the energy savings.

Contract Renewal – You extend the PPA, usually at a reduced rate, since the system has already been paid off.

System Removal – The developer removes the system at their cost, leaving your site as it was before.

Most buyers opt for either renewal or buyout, as the system is still producing energy and offers strong savings. The best choice depends on your energy strategy, site plans, and the condition of the equipment. These options are usually outlined in the original PPA contract to provide clarity well in advance of the term ending.

The PPA is typically funded by the developer or a third-party investor, not the energy buyer. One of the key advantages of a Power Purchase Agreement is that it allows businesses to access renewable energy—like solar or wind—without any upfront capital. The developer handles all costs related to system design, installation, permitting, maintenance, and operation.

To recover their investment, the developer enters into a long-term agreement with you (the buyer), who pays only for the electricity generated—usually at a lower, fixed rate compared to your current grid tariff. This predictable cash flow helps the developer secure financing from banks or energy investors.

In some cases, the system may also be bundled with government incentives, rebates, or renewable energy certificates (RECs), which further improve the project’s financial viability.

So while your business benefits from lower-cost clean energy, it’s the developer—and often their financial backers—who fund and manage the project behind the scenes.

Navigate

© Spinifex 2024. All rights reserved.

© Spinifex Energy. All rights reserved. Website By Dynamic Code